Why is Flood Insurance Important in Florida?

Robert Hartwig, chief economist at the Insurance Information Institute, said Hurricane Katrina could force the largest payout of federal flood insurance in history — in the ballpark of $3 billion, according to a CNN/Money report. However, some consumer groups argue insurance companies should not deny policyholders money on the basis that they don’t handle flood insurance. “The fact that survivors may have to go to court to fight for their rights at a time like this is shameful,” Douglas Heller, executive director of the California-based nonprofit Foundation for Taxpayer and Consumer Rights, said.

From PBS NewsHour: Hurricane Katrina Poses Unique Challenge to Insurance Industry

At Term Brokers, we represent the largest flood insurers in the country. Fidelity National Indemnity Insurance and Travelers Insurance are among the largest and most trusted. Term Brokers, through association with these companies is a participant in the federal government’s National Flood Insurance Program. We are fully qualified to help you find adequate and affordable coverage.

What can you do to prepare?

You should develop a flood emergency action plan that includes the following:

- Contact Term Brokers to add FEMA’s NFIP flood insurance to your current policy.

- Determine whether you live in a flood-prone area.

- If flooding is possible, move valuable items from your home’s basements or first floor to higher floors. Have a checklist of these items in your emergency action plan.

- Keep abreast of road conditions through the news media.

- Move to a safe area before flood water cuts off access.

- If advised to evacuate, do so immediately.

- Do not attempt to drive through a flooded roadway. If the roadway is flooded, turn around.

Coverage for flood or rising water is a separate form of insurance obtained from FEMA through the National Flood Insurance Program and is provided and managed for you by Term Brokers. To make it clear, your homeowners’ policy will not cover flood damage.

Standard homeowners insurance does not cover flooding, it’s important to have insurance protection from the floods associated with hurricanes, tropical storms, surges, heavy rains, and other conditions that impact the Florida Panhandle.

Florida flood water damage is by far the most devastating aftermath of these storms.

Recent storms create devastating water damage” – Bloomberg Business Week, September 8, 2011

Term Brokers Florida Flood Insurance Offers You …

Building Coverage – Covers damage to your dwelling and items such as the furnace and water heater.

Contents Coverage – Covers your furniture, rugs, appliances, and clothing (subject to limitations in basement areas).

Property Protection – Pays for sandbagging and other expenses for preventing flood damage.

Clean-Up Reimbursement – overs the costs of cleaning your home and removing debris after a flood.

Term Brokers has a highly trained professional staff who are knowledgeable about flood losses and able to provide you with superior claim service. Florida flood insurance is very affordable, and we offer multiple deductible options that will save you money and give you excellent care-free protection.

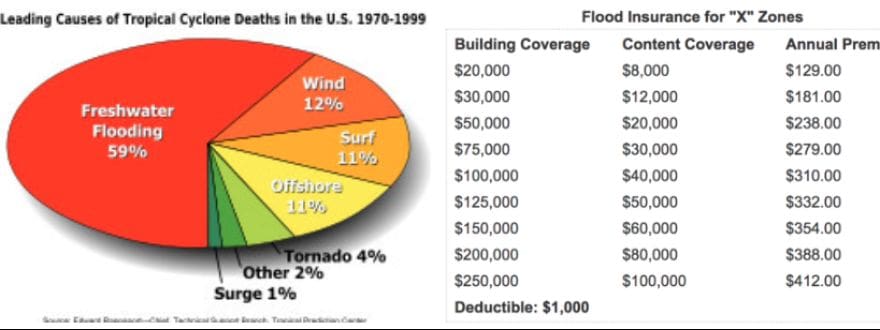

The chart below provides the annual premium for flood insurance with a $500 deductible on a home located in X zones that are not CBRA zones. The first number is the amount of Dwelling coverage and the second number is for your Personal Property. Call us today to find out if you qualify for these affordable rates! If you are not in an X Zone we still offer fast quotes when an Elevation Certificate is available. If you do not have an Elevation Certificate or do not know your zone, call us at 850-864-2000 or email us at quote@termbrokersinsurance.com.