Introduction: Is Your Florida Home Ready for the Next Big Storm?

Your Homeowners’ Insurance Won’t Save You

Here’s a hard truth: standard homeowners’ insurance doesn’t cover flood damage. Whether it’s a storm surge, river overflow, or flash flood, you’re on your own without a separate flood insurance policy.

FEMA reports that 40% of flood insurance claims come from low- or moderate-risk zones, proving no Florida home is immune. Without coverage, a single flood could cost you tens of thousands in repairs—one inch of water can cause $27,000 in damage to a 2,500-square-foot home (FEMA, 2025).

Why Florida Is a Flood Risk Hotspot

- Low Elevation & Flat Terrain: With an average elevation of just 100 feet, water has nowhere to go but your backyard.

- Extensive Coastline: Over 8,400 miles of shoreline face storm surges from hurricanes and tropical storms.

- Heavy Rainfall: Florida averages 60 inches of rain annually, with storms like 2023’s Hurricane Idalia dumping up to 20 inches in a single day.

Urban Challenges: Poor drainage in cities like Miami and Jacksonville worsens flooding during even moderate storms.

Imagine waking up to ankle-deep water in your living room, your furniture ruined, and your savings drained. This was the reality for thousands after Hurricane Helene in 2024. Don’t let your home be next.

Who Needs Flood Insurance in Florida? Everyone.

- Inland Flooding: Heavy rains can overwhelm drainage systems in places like Lakeland or Gainesville.

- New Developments: Urban sprawl increases runoff, putting newer neighborhoods at risk.

- Unpredictable Weather: Tropical storms can form quickly, leaving little time to prepare.

What is a Flood?

The short answer, “An excess of water on land that is normally dry,” is a simple explanation, but most of the time, that doesn’t result in an event where flood insurance will come into play.

The official definition used by the National Flood Insurance Program (NFIP) states:

“A general and temporary condition of partial or complete inundation of two or more acres of normally dry land area or of two or more properties (at least one of which is your property).

What is typically not a flood for insurance purposes?

- Water leaks inside your home. Examples include failed pipes, leaky appliance supply lines, or a burst water heater,

- Roof leaks or wind damage which allow rain inside your home

- Water line failure from the street to your home

- Public water main failure

The Cost of Going Uninsured

Flood damage is expensive and emotionally devastating. Consider these real costs (adjusted for 2025):

- Structural Repairs: Replacing drywall, flooring, and electrical systems can exceed $50,000.

- Personal Belongings: Furniture, appliances, and sentimental items are often total losses.

- Temporary Housing: Displaced families may spend thousands on hotels or rentals during repairs.

In 2024, uninsured homeowners in Pinellas County faced average losses of $85,000 after Hurricane Milton’s storm surge. Flood insurance could have covered most of these costs, saving families from financial ruin.

“This is a substantial rebuild, and because of the fact that we did not have flood insurance, it’s all out of pocket...”

Don Seal of Forest Hills Florida

Flood Zone Risks

FEMA has developed a flood risk system, working with participating communities (most of Florida participates, but not all!), to designate flood risk into four categories: High, Moderate, Minimal, and Unknown.

Each category is then divided into more discrete subcategories primarily based on distance from water sources (ocean, river, lake), property elevation, available drainage, and presence of community mitigation such as levees.

The National Flood Insurance Program uses the FEMA model exclusively.

The image to the right is the Risk Factor map of the 30A from Grayton Beach through Panama City. The darker the color, the greater the flood risk.

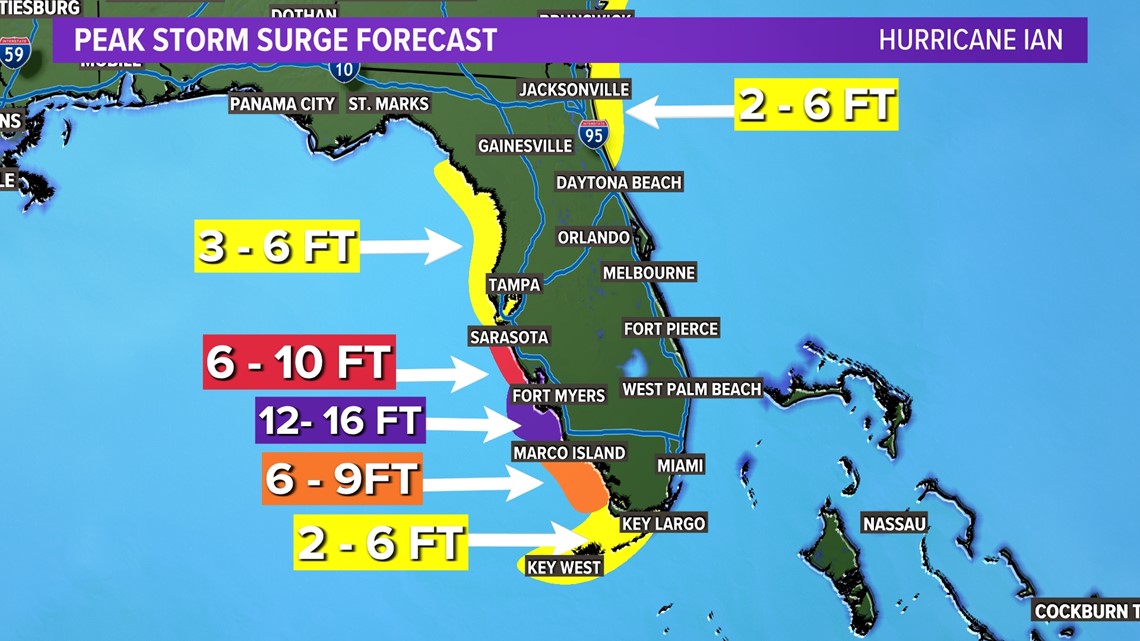

Coastal property owners are at high risk of damage from flooding due to storm surges. Hurricane Ian in September 2022 was a particularly nasty storm that flooded much of the west coast of Florida.

Slow moving tropical storms as “Fay” can flood inland regions with tremendous amounts of rain.

There are competing flood risk tools such as Risk Factor which private flood insurers may use in addition to or in lieu of the FEMA model. This is why private flood insurance can sometimes be cheaper than NFIP quotes.

| FEMA Zone | Short Description |

|---|---|

| A | Areas subject to inundation by the 1-percent-annual-chance flood event are generally determined using approximate methodologies. |

| AE, A1-A30 | Areas subject to inundation by the 1-percent-annual-chance flood event determined by detailed methods. Base Flood Elevations (BFEs) are shown. |

| AH | Areas subject to inundation by 1-percent-annual-chance shallow flooding, typically areas of ponding, where average depths are between one and three feet. Base Flood Elevations (BFEs) derived from detailed hydraulic analyses are shown in this zone. |

| AO | Areas subject to inundation by 1-percent-annual-chance shallow flooding, usually sheet flow on sloping terrain, where average depths are between one and three feet. Average flood depths derived from detailed hydraulic analyses are shown in this zone. |

| AR | Areas that result from the decertification of a previously accredited flood protection system that is determined to be in the process of being restored to provide base flood protection. |

| A99 | Areas are subject to inundation by the 1-percent-annual-chance flood event, but will ultimately be protected upon completion of an under-construction Federal flood protection system. These are areas of special flood hazard where enough progress has been made on the construction of a protection system, such as dikes, dams, and levees, to consider it complete for insurance rating purposes. |

| V | Areas along coasts are subject to inundation by the 1-percent-annual-chance flood event with additional hazards associated with storm-induced waves. |

| VE, V1-V30 | Areas subject to inundation by the 1-percent-annual-chance flood event with additional hazards due to storm-induced velocity wave action. Base Flood Elevations (BFEs) derived from detailed hydraulic analyses are shown. |

| D | Areas with possible but undetermined flood risk. |

| X (shaded), B | Areas of moderate flood hazard between limits of the 1-percent-annual-chance floodplain and the 0.2-percent-annual-chance floodplain. |

| X (unshaded), C | Areas of minimal flood hazards outside 0.2-percent-annual-chance floodplain. |

Reality Check

Florida has witnessed a cyclical increase in major hurricane frequency, with 4 in the past seven years. Is that a high for Florida? No, it’s not. Florida had seven major hurricanes between 1944 and 1950! That’s an average of one per year.

On the other hand, Florida had just eight major hurricanes between 1951 and 1995, with an average of one every 5 ½ years! Since 1996, Florida has averaged a major hurricane every 3.4 years. Furthermore, Florida, as we noted, is an extensive state; therefore, landfall and paths can and will vary dramatically.

To the right is a map of Florida hurricane paths from the NOAA Historical Hurricane website.

This is why Floodplain models refer to 100-year events and 500-year events. While the odds of a major hurricane coming to your town for an individual year are low, over a 30-year mortgage, the cumulative odds of significant flooding can reach 1 in 4 in high-risk flood zones.

Conclusion: Why do I need flood insurance in Florida?

With NOAA predicting an above-average 2025 hurricane season (15-20 named storms), the next flood could be weeks away. Flood insurance is your shield, but it comes with a 30-day waiting period, so don’t delay.

Next Steps:

Check Your Risk: Use FEMA’s flood maps or First Street to better understand your properties risk from flood.

Get Prepared: Call us today 850-864-2000.

Stay Tuned: In Part 2: Fortifying your home, we’ll break down mitigation options to protect your home from floodwaters. Then, explore Part 3: Flood Insurance Options to help you make informed choices.

Your home is your haven—don’t let a flood steal it. Take the first step to protect what matters most today!

This is part 1 of a 3-part series. Continue to Part 2.

Updated May 2025.

2 Responses