A 3-part primer on flood insurance in Florida

Part 1: Why do I need Flood Insurance in Florida

Part 2: This article focused on flood mitigation

Part 3: Flood Insurance Options

The Florida Panhandle is no stranger to Mother Nature’s fury, with hurricanes often making landfall and leaving a trail of destruction in their wake. For homeowners along this picturesque stretch of coastline, preparing for these natural disasters is not just a matter of preference; it’s a necessity. In this comprehensive guide, we’ll explore the critical concepts of flood mitigation, including the partnership between FEMA, the state, and local communities, and offer practical advice on making your home more resilient to floods from severe storms through recommended flood mitigation strategies.

Understanding Base Flood Elevation

Base flood elevation (BFE) is an essential concept in flood mitigation. BFE is the elevation floodwaters may reach during a 100-year flood event. FEMA uses this metric to determine flood risk and establish minimum requirements for building construction in flood-prone areas. By understanding your property’s BFE, you can make informed decisions about how to protect your home from potential flood damage.

Freeboard is an additional height above the base flood elevation used as a safety factor in determining the level at which a structure’s lowest floor must be elevated. The latest Florida building code specifies the minimum amount of freeboard based on the property’s flood risk assessment. More freeboard increases safety and resilience and can dramatically lessen flood insurance costs.

Elevation Certificates and the Role of Building Codes

An Elevation Certificate (EC) recognizes the site’s BFE and freeboard and documents the building’s compliance with local code. It is a critical tool for determining the appropriate flood insurance rates for a property, as insurers use the EC to assess the risk of flooding and set the correct premium.

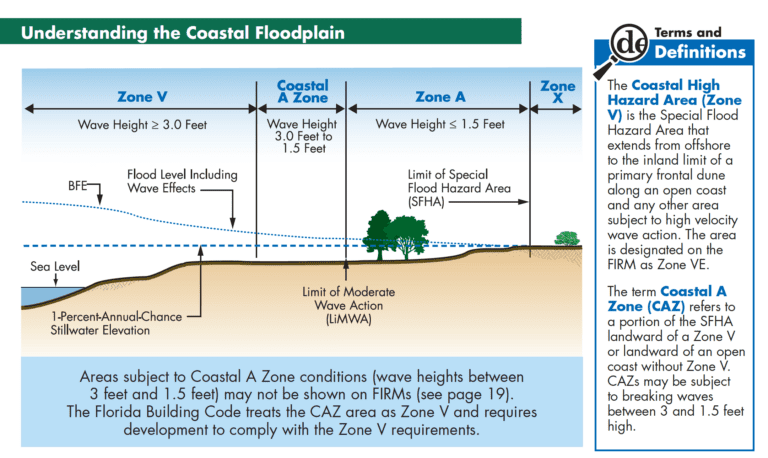

The FEMA, State, and Community Partnership

Mitigating the risk of hurricane damage is a shared responsibility between FEMA, the state, and local communities. FEMA, which manages the National Flood Insurance Program (NFIP), works with communities to assess risk, which is documented in flood insurance rate maps (FIRMs). These maps help property owners understand their flood risk and inform local governments about areas that require additional flood protection measures. Local communities play a crucial role in flood mitigation by implementing zoning regulations and ensuring new construction is limited to areas less prone to flooding. Additionally, local communities are responsible for mitigation efforts, such as constructing coastal barriers and drainage systems, to protect buildings from floodwaters.

The state of Florida writes comprehensive building codes designed to safeguard public health, safety, and general welfare. The state also regulates insurers and operates Citizens, the Florida insurer of last resort.

By working together, FEMA, the state, and local communities can create a more resilient community that can weather the storms together.

Improving Your Home's Resilience to Floods with Flood Mitigation

As a homeowner in the Florida Panhandle, if your home predates the 6th Edition Florida Building Code (2017), there may be several steps you can take to improve your home’s resilience to floods from severe storms. These mitigations include:

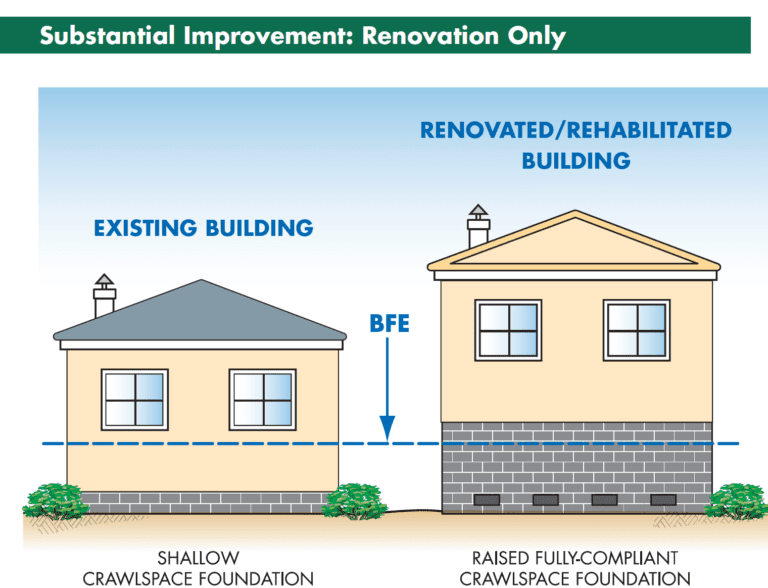

Elevate your home: If your home was not built to the latest BFE + freeboard guidelines, consider elevating it to reduce the risk of flood damage. Elevation can be achieved by raising the entire structure or by moving critical utilities and living spaces to higher floors.

Install flood openings: Flood openings allow water to flow through your foundation during a flood event, reducing the pressure on your foundation and walls. These openings also help floodwaters to drain quickly after the event.

Waterproof your home: Use flood-resistant materials, such as concrete or pressure-treated wood, for your home’s construction. Apply waterproof coatings to walls and seal openings to prevent water intrusion.

Maintain your property: Keep your gutters and downspouts clear of debris and grade your yard away from your home to facilitate proper drainage.

Create a flood plan: Develop a plan for protecting your home and family during a flood event, including evacuation routes, emergency supplies, and a communication strategy.

Conclusion

Flood mitigation is a critical concern for homeowners in the Florida Panhandle. By understanding key concepts such as base flood elevation + freeboard, flood insurance rate maps, and the partnership between FEMA, the state, and local communities, you can take proactive steps to protect your home from the devastating effects of severe storms. By elevating your home, installing flood openings, waterproofing your property, maintaining your property, and creating a flood plan, you can significantly reduce the risk of flood damage and ensure your family’s and your investment’s safety. Remember, flood mitigation is not just about protecting your home; it’s about building a more resilient community that can weather the storms together.

This is part 2 of a 3-part series. Part 1 covers why you need flood insurance. Part 3 is coming soon.

One Response