Do I need flood insurance? A flood insurance primer.

Hurricane Ian, as many of you may already know, caused significant devastation across the state of Florida, bringing about extensive flooding from the location of its landfall close to Fort Myers, all the way up to Orlando and even reaching Jacksonville. The aftermath of such a catastrophic event has left many people pondering about the necessity of purchasing flood insurance.

It’s certainly not an easy decision to make, and there are many important factors to consider. While the government does have programs in place to offer assistance in times of natural disasters, the coverage provided may not be adequate for everyone’s needs. Depending on the location of your property, its proximity to water sources, and other key factors, the purchase of flood insurance may be a wise investment in order to protect your valuable assets and give you peace of mind in the face of future unforeseen events.

The 4 most common questions:

- Do I need flood insurance?

- What does flood insurance cost?

- What are my options?

- What does flood insurance cover?

Do I need flood insurance?

You may not just need it; you may be required to purchase flood insurance. First, let us explore the different levels of flood risk.

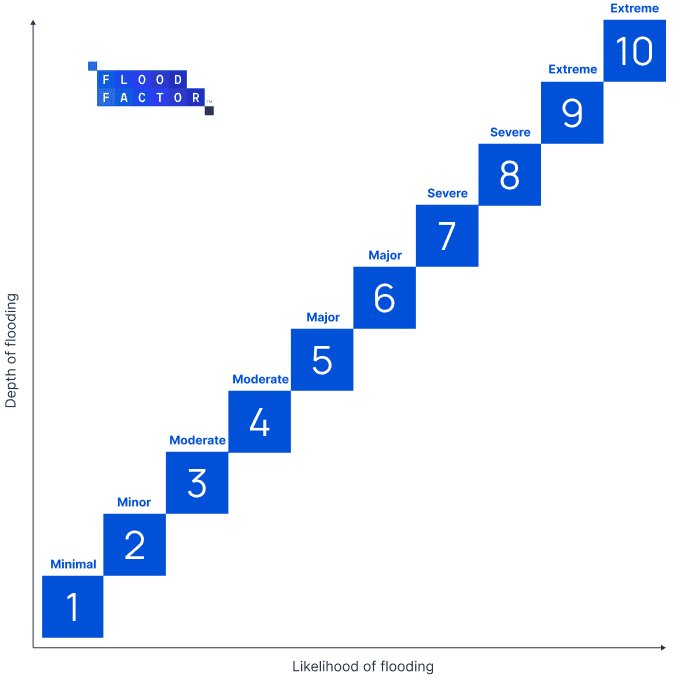

We recommend using Risk Factor (formerly Flood Factor) as the starting point. Your lender or realtor may have another solution to aid in your research. Risk Factor is a free tool created by the nonprofit First Street Foundation.

Visit Risk Factor at: https://riskfactor.com/

Then, enter the property address. Risk Factor will summarize the flood risk level for the given address from 1 (Minimal) to 10 (Extreme).

If the property is in a major, severe, or high-risk flood zone your lender may REQUIRE flood insurance.

Otherwise, it’s usually an optional expense. But while optional, it’s highly recommended anywhere in Florida.

Important note: Many insurers (particularly Citizen’s) are now requiring flood insurance.

To better understand risk in the table above we recommend watching this Risk Factor video.

How much does Flood Insurance cost?

The average cost of flood insurance through the National Flood Insurance Program (NFIP) is $738 per year, but flood insurance rates will vary depending on your home’s location and the coverage required.

What are my options for flood insurance?

For low-value homes, the National Flood Insurance Program NFIP is an excellent option; however, it’s not an option for homes where rebuilds will cost more than $250,000. The Flood Smart website is an incredible resource covering flood risk, flood preparation, and more.

For those with more higher-value homes the private insurance market will have policy choices for your consideration.

Why should those in minimal to moderate risk consider flood insurance? Because 1 in 5 flood insurance claims come from lower risk areas!

Many homeowners roll the dice on the bet a flood won’t happen to them, and if it does, FEMA will cover the expenses.

Can you depend on FEMA to have your back?

FEMA assistance is not the same as insurance, nor can it make the survivor whole. FEMA makes this statement on their website:

“Financial assistance may be available for eligible homeowners to rebuild or make basic repairs to make their home safe, sanitary, and functional again.”

For Hurricane Ida in 2021 FEMA granted 735,968 households $480 million. That may seem like a lot, but that’s an average of just $666 per household.

What does flood insurance cover?

Building coverage typically includes:

- Electrical and plumbing systems

- Furnaces and water heaters

- Refrigerators, cooking stoves, and built-in appliances like dishwashers

- Permanently installed carpeting

- Permanently installed cabinets, paneling, and bookcases

- Window blinds

- Foundation walls, anchorage systems, and staircases.

- Detached garages

- Fuel tanks, well water tanks and pumps, and solar energy equipment

Contents coverage typically includes:

- Personal belongings such as clothing, furniture, and electronic equipment

- Curtains

- Washer and dryer

- Portable and window air conditioners

- Microwave oven

- Carpets not included in building coverage (e.g., carpet installed over wood floors)

- Valuable items such as original artwork and furs (up to $2,500)

How do I get flood insurance?

Complete your online quote request now at Flood Quote.

Or give Term Brokers a call at 850-684-2000. Our experts will review the options with you to ensure peace of mind.