Florida Flood Insurance Requirements

We are seeing the effects of the passage of 2022 Senate Bill 2A.

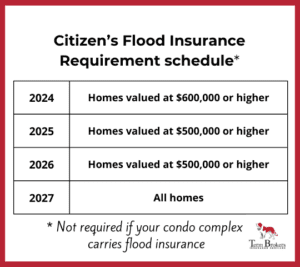

The most obvious is that many Citizens’ policyholders must purchase flood insurance. Effective March 1st, flood insurance is no longer an option for homes valued at $600,000 or higher! The value drops $100,000 annually through 2026; in 2027, it will apply to all Citizen policies. The most important exception is that flood protection is not required for condos if the condominium association carries flood insurance for the complex.

We also see other carriers demanding flood coverage depending on the homes’ proximity to the coast and the flood zone. Don’t be surprised if you must purchase flood insurance for both new and renewed policies.

We also see other carriers demanding flood coverage depending on the homes’ proximity to the coast and the flood zone. Don’t be surprised if you must purchase flood insurance for both new and renewed policies.

The law also significantly adjusted how fast carriers must respond when you file a claim. At the same time, the law requires policyholders to file claims within one year of occurrence.

There is an interesting proposal to change Citizens from a state-run carrier of last resort for homeowners insurance to become THE provider of wind coverage for everyone. This proposal is unlikely to see action this year.

Ever wonder how state actions might affect your insurance? We’ve got you covered! We monitor the latest developments and keep you informed so you can focus on what matters most.

Now is an excellent time to take a fresh look at flood insurance for your home. You can purchase either private or NFIP coverage through Term Brokers.