Tips for managing Florida's insurance squeeze

Sunshine State dreams are getting soaked by a financial storm. Florida’s homeowner’s insurance costs are surging, leaving many wondering if they can keep their roofs afloat. But fear not, fellow Floridians! This blog post is your life raft, guiding you through the choppy waters to calmer shores of affordable coverage by following our tips for smart home insurance savings.

Don’t let rising costs rain on your parade:

- Maria from Niceville: A single mom, Maria was facing a 30% premium hike. By taking advantage of wind mitigation discounts for her roof upgrade, she slashed her bill by 20%, saving enough for her daughter’s annual college fund contribution!

- John from Destin: John always thought raising his deductible was risky. But after crunching the numbers, he realized the increase could save him hundreds per month. Now, he has a healthy emergency fund and peace of mind.

Empower yourself, one tip at a time:

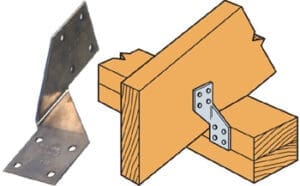

Roof fortify: Your roof is your first line of defense. Upgrading to hurricane clips and impact-resistant shingles can earn you discounts of up to 35% – like a hurricane-proof piggy bank! Find a licensed wind mitigation specialist to navigate the options.

A home with comprehensive wind mitigation improvements is eligible for discounts of up to 35% off the wind portion of your policy. To learn more about wind mitigation options, visit:

https://www.myfloridacfo.com/division/ica/planprepareprotect/Mitigation

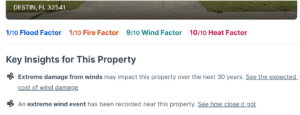

Location, location, location: Flood and storm zones? Brace for higher rates. But don’t despair! Utilize risk factor maps to compare potential homes before you buy, saving yourself future financial headaches.

You can review flood and wind risk for potential homes by using

Risk Factor: https://riskfactor.com/

Raise the bar (on your deductible): Think of your deductible as a self-insurance shield. Bumping it up to a slightly uncomfortable level can significantly lower your premiums. Just remember to build a rainy-day fund to cover potential repairs.

Credit score superpowers: Your credit score is like a financial force field. Improving will help reduce higher premiums.

Discount detective: Every insurer has hidden treasure! Ask about bundled policies, home security perks, and even military or senior discounts. You might be surprised at the savings you unearth.

Arbitration ace: Some insurers offer discounts for agreeing to arbitration in case of disputes. Arbitration can be a win-win – you save on premiums and get faster dispute resolutions.

Remember, you’re not alone in this storm. Term Brokers is here to partner with you and Florida’s top insurers to find the best coverage at the best price. Let’s weather this financial hurricane together, one cost-saving tip at a time.

Take action today!

Contact Term Brokers today for a free affordable home insurance quote and navigate to calmer insurance waters.

One Response